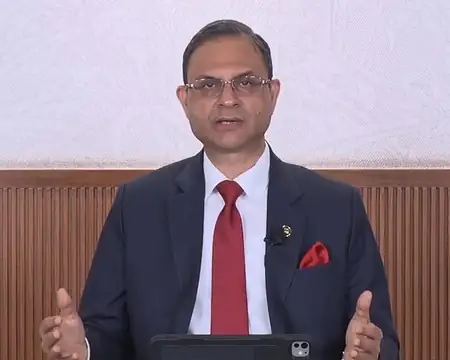

Friday brought welcome news for India’s banking public as RBI Governor Sanjay Malhotra outlined transformative policies. A new compensation regime targets low-value transaction frauds, mandating bank reimbursements.

Stemming from a review of 2017’s electronic transaction safeguards, these updates account for explosive growth in digital finance. Key enhancements include dedicated frameworks for small fraud payouts, with drafts slated for public discourse soon.

The governor noted technology’s double-edged sword—innovation alongside vulnerabilities. Revised instructions will refine liability scenarios and timelines, offering stronger nets for affected account holders.

Equally critical is the clampdown on financial product mis-selling by banks and NBFCs. Grave consequences demand rigorous oversight: all counter-sold third-party items must fit customers’ needs and risk capacities.

Broad instructions for REs on product promotion and sales are being drafted for consultation. Meanwhile, loan recovery norms see consolidation. Existing fragmented directives for recovery agents across entities will unify, streamlining operations ethically.

Collectively, these reforms herald a customer-first era. The RBI’s proactive stance on fraud compensation, ethical selling, and fair collections will enhance trust, stability, and growth in the banking domain.